Products You May Like

Using the telecom capex cycle We not too long ago interacted with Dr. Anand Agarwal, Group CEO, Sterlite Technologies (Sterlite). Key highlights: 1) Sterlite is on observe to change into a converged community options supplier from plain vanilla telecom product participant. 2) No want for added acquisitions or capability addition than already introduced to satisfy the Rs 100bn annualised income run fee by Q4FY23. 3) OF/OFC demand is strong as telecom firms are investing in rising capacities. We consider prudent investments have helped Sterlite increase in adjoining areas and the corporate is in a candy spot bolstered by its strengthened capabilities and accelerated community investments. Keep ‘BUY’ with Rs 386 goal value.

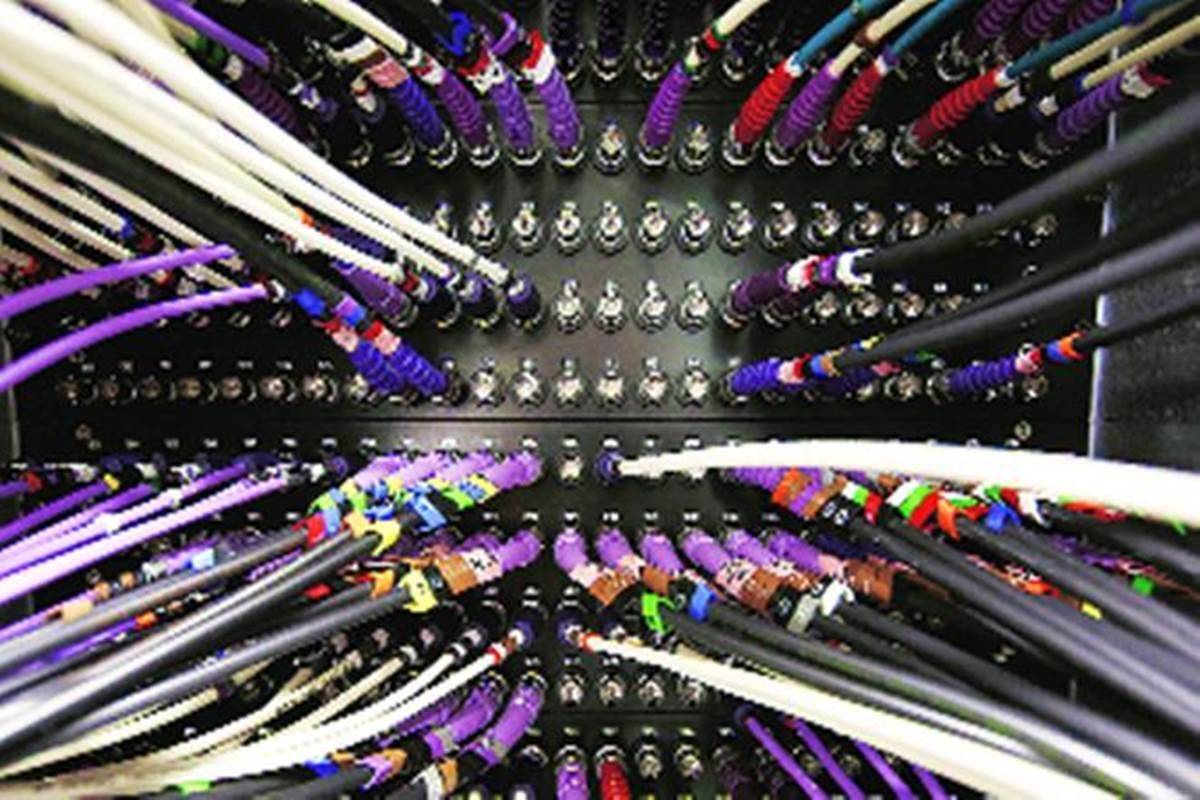

Increasing addressable market: Entry in System Integration, Community Software program, Virtualized Entry, amongst others, has expanded Sterlite’s addressable market to a whopping $40bn from mere $7.5bn market as an optical options supplier. The corporate has constructed capabilities organically in addition to through acquisitions. Sterlite is leveraging its optical community capabilities as a hook to seize greater pockets share of the telecom capex. Because the expertise can be altering with virtualisation of the community, telecom operators are taking a look at converged telecom community suppliers who’ve capabilities in software program in addition to {hardware}—Sterlite’s forte.

Associated Information

US/Europe markets supply important development alternatives: Sterlite has systematically expanded its providers portfolio from authorities providers to Indian non-public service suppliers. The corporate has already bagged contract to roll out fiber community in UK. It is usually trying to increase its choices by offering extra value-added providers leveraging ORAN software program capabilities. Equally, after creating sturdy presence within the European market, Sterlite is now increasing OFC capability within the US; this market is massive with presence of regional community suppliers, hyperscalers, other than the highest telecom operators. The corporate has employed the sources and will likely be constructing OFC capability to seize this market

Outlook and valuations: Robust demand pattern; keep ‘BUY’: We consider covid has accelerated the shift to digital, which is accelerating community investments. That is mirrored in community creation cycle pushed by 5G, FTTx and rural connectivity programmes. The burden of investments in digital infrastructure is shared by cloud firms, PE companies, enterprises and citizen networks, other than telecom firms. Moreover, new applied sciences like 5G, FTTx and ORAN at the moment are turning into mainstream, which successfully brings fiber nearer to customers.

This capex cycle bodes nicely for Sterlite’s income development as the corporate has constructed varied capabilities to offer end-to-end options. Contemplating sturdy development prospects, excessive return ratios and strong order guide, we consider valuations at 12.9x FY23E EPS are engaging. We keep ‘BUY/SO’ with TP of Rs 386 (20x Q3FY23E EPS).

Get reside Stock Prices from BSE, NSE, US Market and newest NAV, portfolio of Mutual Funds, Take a look at newest IPO News, Best Performing IPOs, calculate your tax by Income Tax Calculator, know market’s Top Gainers, Top Losers & Best Equity Funds. Like us on Facebook and observe us on Twitter.

Monetary Categorical is now on Telegram. Click here to join our channel and keep up to date with the most recent Biz information and updates.