Products You May Like

For Canada’s growing start-up ecosystem, the tax hike could mean a dampening of U.S. investor appetite for early stage companies

Article content

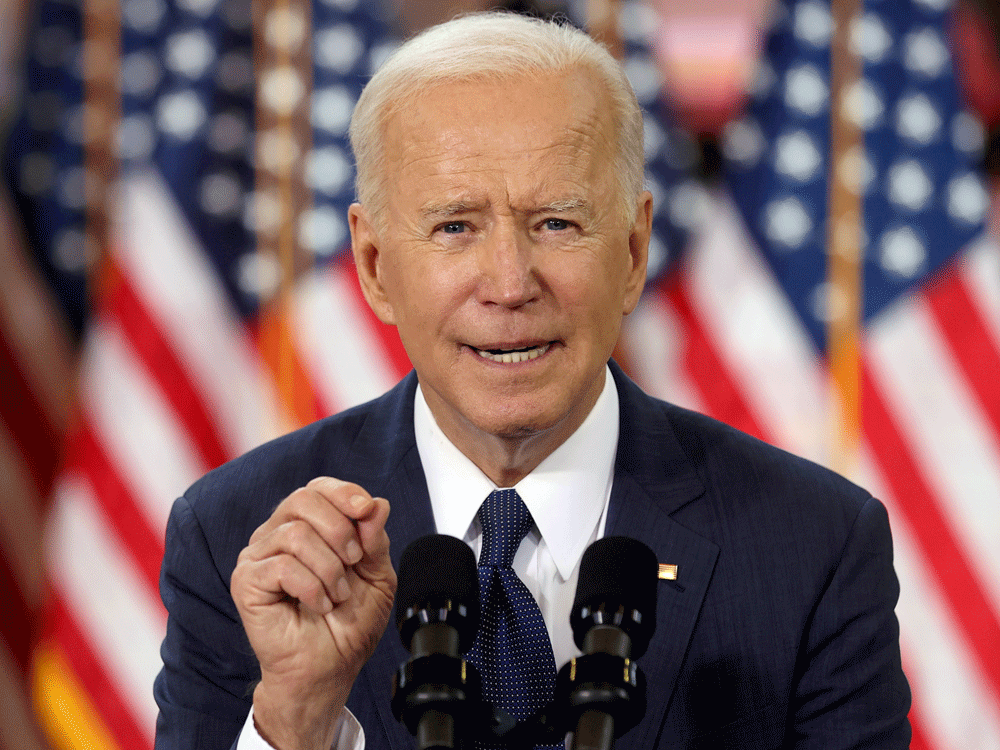

U.S. President Joe Biden’s potential capital gains tax hike could deal a blow to entrepreneurs in Canada if it dissuades American investors from taking risks on startups north of the border.

If presented as expected, the plan could nearly double taxes on capital gains — the income earned on the sale of a stock or other assets — to 39.6 per cent for households earning more than $1 million. It would be the highest tax rate on investment gains in the U.S. since the 1920s.

The president is expected to announce the hike on Wednesday as an option to fund his American Families Plan, which is aimed at helping boost the pandemic-ravaged economy by devoting money to national childcare, paid family leave and tuition-free community college. The plan could come with a price tag of more than US$1 trillion.

For Canada’s growing start-up ecosystem, it could mean a dampening of U.S. investor appetite for early stage companies.

Article content

National Angel Capital Organization chief executive Claudio Rojas said that tax policies should incentivize funding startups to help create jobs and scale companies, and that a capital gains tax that removes investor reward for taking those risks could cool angel investments.

In Canada, where most startups are in the early stages of development, backing nascent companies is the riskiest stage compared to the more mature startup environment in the U.S., he said.

Early stage startups accounted for nearly half of all venture capital deals and 40 per cent of total dollars invested in 2020, according to the CVCA report.

“The U.S. start-up economy with the massive success stories in Silicon Valley may continue attracting high levels of investment as a result of its ecosystem having a lower level of risk, ours would be more significantly impacted because its really just starting to pick up steam,” Rojas said.

U.S. investors are a key source of capital for Canadian startups. U.S. firms were among the top five most active funds in Canada in terms of total dollars invested, according to a 2020 report from the CVCA.

Versant Ventures in San Francisco founded and invested in two-year-old Montreal-based Ventus Therapeutics and New York-based OrbiMed Advisors, one of the world’s largest biotech investors, and Silicon Valley billionaire investor Peter Thiel backed Vancouver-based AbCellera’s Series B funding round before it launched its IPO in December, becoming one of Canada’s most valuable public biotech companies.

Article content

In the past, the removal of taxes on small business or start-ups has triggered a rise in investor activity, according to Alex Edwards, director of the CPA Ontario Centre for Accounting Innovation Research and accounting professor at the Rotman School of Management.

In a 2018 report, Edwards examined a 2010 regulatory change in the U.S. that exempted certain small business investments from capital gains tax. He found that average funding per round surged by 12 per cent.

“They were able to raise more funding, and they were raising the funding at higher valuations,” Edwards said.

A hike could have the opposite effect.

“For those U.S. investors that are subject to an increase in the capital gains tax rate, it might have a bit cooling effect on the amount they’re investing into all startups, including the Canadian ones,” he said.

The pending U.S. hike was announced the same week that the Canadian government tabled its federal budget. Some had speculated as to whether the capital gains inclusion rate, with is currently set at 50 per cent, would be increased as a way to help the government pay down the soaring deficit and fund COVID-19 relief spending, but ultimately the Trudeau government made no changes.

A hike in the U.S., however, could prompt a similar move in Canada, according to Jamie Golombek, CIBC’s managing director of tax and estate planning and a Financial Post columnist. Currently, the inclusion rate here is at its lowest point in decades. It was as high as 75 per cent in the 1990s, until it was slashed to 50 per cent in 2000.

“It would certainly put more pressure on Canada to follow suit, because we often do follow the U.S. on tax policy,” Golombek said.