Products You May Like

Good Morning!

We have now all heard how the pandemic recession was not like any we’ve ever seen.

Now a brand new report affirms simply how deeply bizarre this disaster has been.

The Credit score Suisse World Wealth Report, which claims to be probably the most complete supply of data on international family wealth, says so far as the world’s wealth goes it’s virtually as if the worst recession in latest reminiscence had by no means occurred.

“The distinction between what has occurred to family wealth and what’s taking place within the wider financial system can by no means have been extra stark,” says the report.

“Stranger nonetheless, international locations most affected by the COVID-19 pandemic have usually been these recording the best good points in wealth per grownup.”

Whole international wealth grew 7.4% in 2020, with wealth per grownup climbing 6% to achieve a file excessive of US$79,952. That’s two and a half instances the common wealth in 2000.

Within the monetary disaster of 2008, wealth per grownup plunged 13.9% within the U.S. and 22.9% in Canada.

The explanations for this are clear, stated Credit score Suisse. Governments and central banks, anxious to not repeat the errors of the monetary disaster, shortly pumped cash to companies and people and lowered rates of interest, making it clear charges would keep low for a while.

“The decreasing of rates of interest by central banks has in all probability had the best affect,” Credit score Suisse stated.

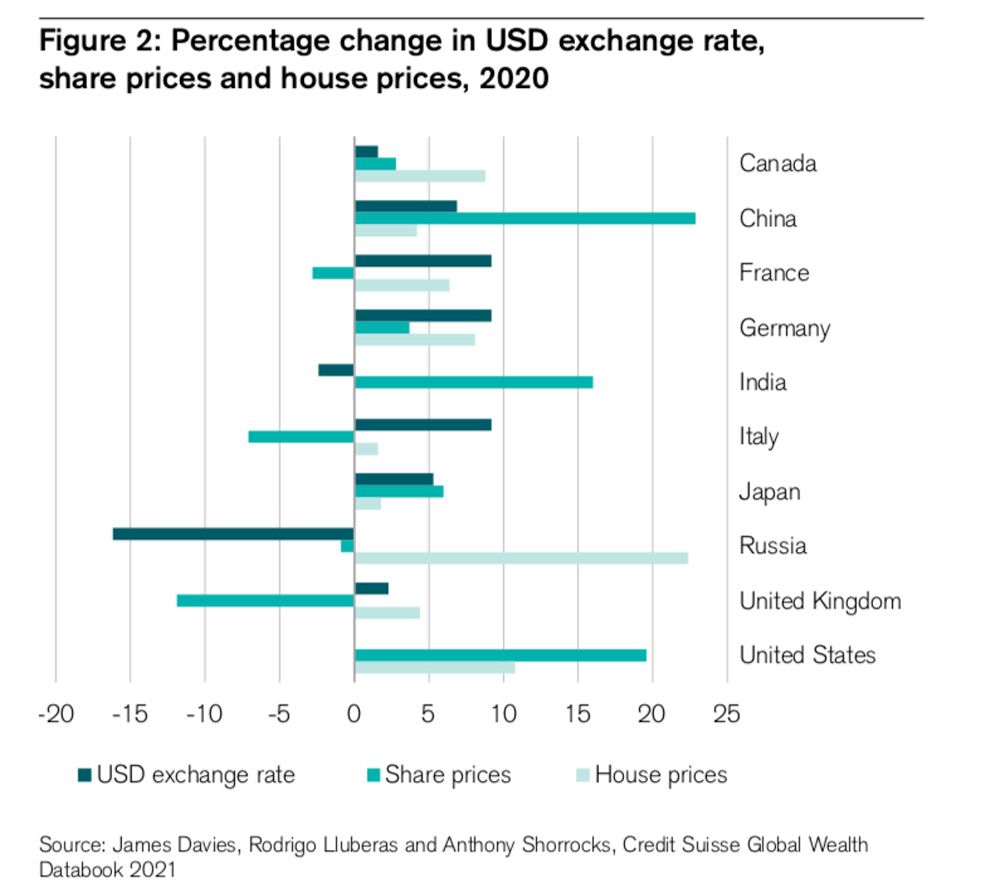

Decrease charges, together with unplanned financial savings, lit a fireplace below housing markets, not simply in Canada, however all over the world. In Russia, house costs rose 22%, in Turkey 31%, together with Austria, Canada, Czechia, Denmark, Germany, Poland and Sweden, which noticed will increase of between 8% and 11%.

It was the mixture of rising asset costs, together with forex appreciation in opposition to the U.S. greenback (the loonie was buying and selling at 81.33 US cents in the present day) that boosted wealth all over the world.

Canada ranks within the high 10 international locations for wealth good points per grownup in 2020, with Switzerland and Australia topping the listing.

That is one other shocking characteristic of this recession: the international locations that noticed the most important hits to their GDP have finished disproportionately effectively in wealth progress. Credit score Suisse cites Canada, Belgium, Singapore and the U.Ok. as examples.

“Regardless of being among the many worst-affected international locations, with a mean GDP lack of 7.1%, they achieved unusually excessive wealth good points averaging 7.7% internet of trade fee concerns. Thus the dimensions of the wealth achieve exceeded the magnitude of the GDP loss.”

The ranks of world millionaires swelled by 5.2 million to 56.1 million in 2020. Canada gained 246,000 millionaires, the eighth highest achieve on this planet.

Globally, you now want greater than US$1 million for entry into the world’s high 1%.

“2020 marks the yr when, for the primary time, greater than 1% of all international adults are greenback millionaires,” stated Credit score Suisse.

However whereas wealth inequality within the U.S. has widened, it has narrowed in Canada. Since 2007, the wealth share of the highest 10% of wealth holders has risen from 71.6% to 75.7% in the USA, however has fallen in Canada from 57.1% to 56.5%.

Credit score Suisse says one purpose for that is that inventory costs within the U.S. have risen greater than in Canada, growing the wealth of the highest teams. In Canada, house costs have risen quicker, lifting the wealth of the center class.