Products You May Like

With the top-up SIP, even just a little further could make a major distinction in your wealth accumulation plans and allow you to succeed in your targets quicker.

Virtually all the things comes with a top-up lately. When you look into your information plan, there’s a top-up facility for all the things from your own home mortgage to non-public loans. Now you can avail a top-up possibility and get extra funds together with your revenue remaining the identical. Equally, insurance coverage insurance policies too provide top-up plans. However do you know it’s also possible to increase your mutual fund systemic funding plans (SIPs) via top-ups?

To place it in perspective, a top-up SIP lets you improve the mutual fund funding quantity that you just contribute every month to the fund. It’s a versatile possibility and relies on a selected share of your selection and even a certain quantity of the unique SIP.

Sometimes, if you make investments a sure sum of money each month via a long-term SIP, you profit from the potential of compounding wealth over the long term. Whenever you prime up your SIP, you select to extend the quantity of your SIP instalment to try at attaining your monetary targets quicker.

Let’s perceive this with an instance.

Let’s say you started a month-to-month SIP of Rs 20,000 for 20 years with an assumed 11% return charge over the timeframe.

This SIP quantity has the potential of constructing a corpus of roughly Rs 1.75 crore on the assumed rate of interest of 11% in opposition to your funding of Rs 48 lakh.

With an increase in your revenue, you now resolve to prime up your month-to-month SIP quantity by 10%.

This resolution might help you create a corpus of roughly Rs 2.82 crore in your funding of Rs 93.60 lakh. Because of this growing or topping up your month-to-month SIP by simply 10% yearly can provide the potential of a further Rs 1 crore corpus.

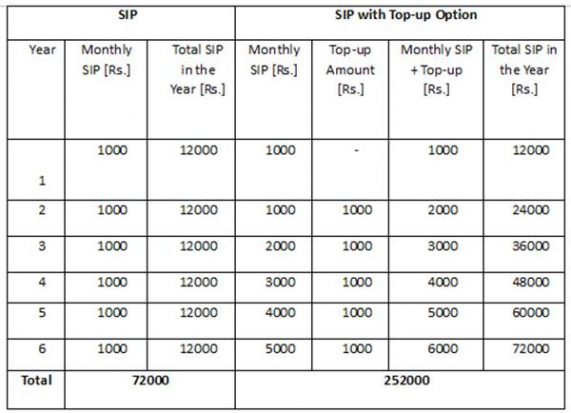

Allow us to take a look at how an everyday SIP is completely different from a SIP plan with a top-up facility. Within the desk under, you’ll see that the potential of accruing a extra appreciable sum with a top-up SIP is way increased than an everyday SIP in the identical timeframe.

Now allow us to speak about how are you going to prime up your SIP.

How High-Up SIP Can Work For You

- Elevated revenue, increased SIP quantity. How a lot you make investments relies on your revenue. Maybe initially of your profession, your SIP investments could have been a lot smaller. However an increment, both via an annual bonus or a increase, can allow you to make use of the additional cash as a top-up to your current SIP. A top-up SIP maintains a consolidated funding. It offers you with the choice of enhancing the SIP quantity slowly to build up wealth quicker.

- Speeds your monetary goals. A slight improve in your SIP investments, regardless of how small, could be helpful. When you’re seeking to attain your targets quicker, growing your investments or topping up your current SIP plan could be a really perfect possibility.

- Helps beat inflation. Relating to your investments, inflation is usually a monster. That’s as a result of, with each passing 12 months, the inflation charge continues to rise and persistently erodes the value of your cash. Subsequently, to remain consistent with inflation, chances are you’ll need to contribute a better quantity to your funding plan for the long term. In that regard, a top-up SIP could be a superb choice to sustain with inflation. With a periodic and common improve in your funding quantity, you might be able to sustain with the price of residing sooner or later.

- It’s easy and easy. Starting an SIP for each purpose could be tiresome, particularly if it’s important to monitor, monitor and handle a number of SIPs. Maybe chances are you’ll not have the time to check a brand new funding alternative. Subsequently, topping up the SIP to your current SIP is usually a appropriate possibility.

What You Want To Know Earlier than Topping Up Your SIP

- When enrolling for the SIP facility, bear in mind to go for the top-up possibility.

- Virtually each AMC permits a minimal top-up quantity of Rs 500 and in multiples of Rs 500. Some AMCs additionally will let you improve an outlined share yearly.

- Having enrolled for a top-up SIP, chances are you’ll be unable to change the small print. When you want to make any revisions, you have to discontinue the prevailing SIP and start a brand new SIP with a top-up possibility.

- Usually, each SIP gives a top-up possibility.

- When availing of the top-up possibility within the SIP, you do not want to replenish particular person ECS debit mandates.

Most buyers suppose that creating wealth requires a substantial sum of money. However with an SIP funding, tyou have the chance of rising your cash over time. Moreover, with the top-up SIP, even just a little further could make a major distinction in your wealth accumulation plans and allow you to succeed in your targets quicker.

(By Renjith RG, Affiliate Director at Geojit Financial Services)

Monetary Categorical is now on Telegram. Click here to join our channel and keep up to date with the most recent Biz information and updates.