Products You May Like

Within the age of social distancing, when security is of paramount concern, individuals are going out of their strategy to keep away from bodily contact, particularly in public areas. Whether or not it’s paying for groceries, medicines or meals supply, individuals are adopting contactless methodology of funds. And one such business chief offering a number of contactless cost options is SBI Card.

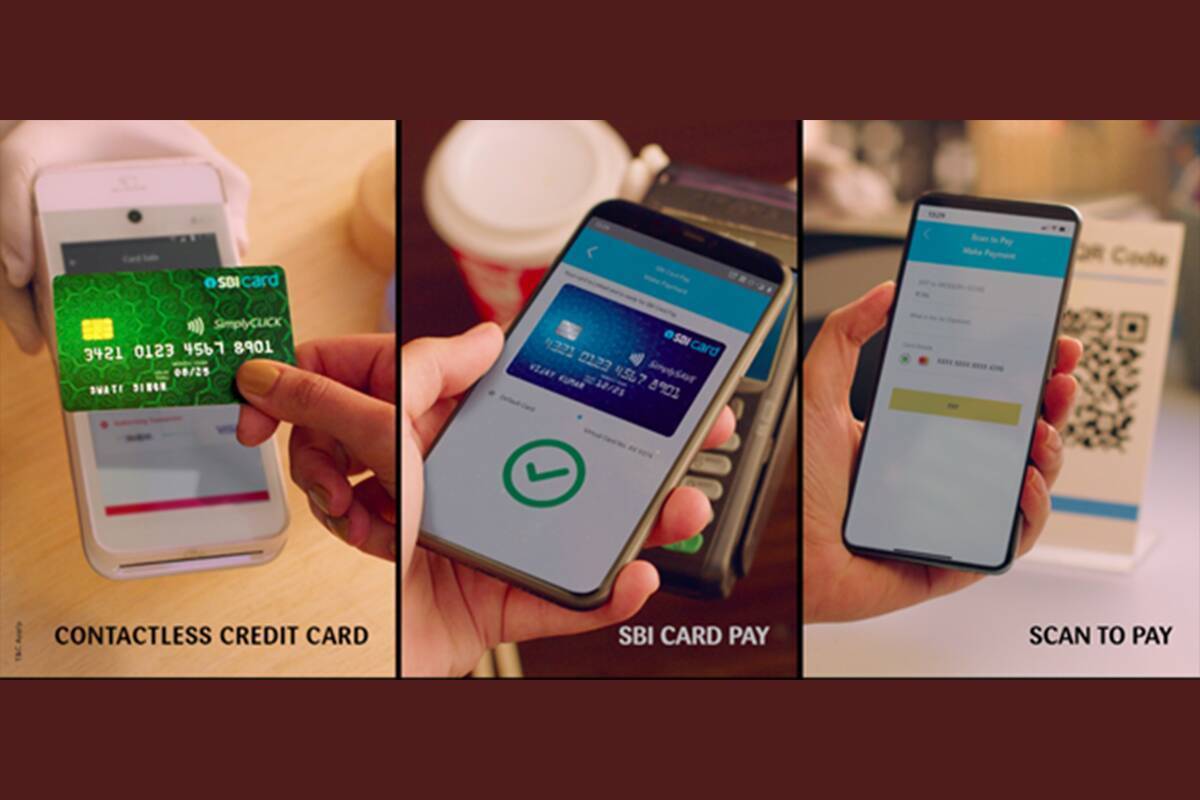

SBI Card with its SBI Card Pay, Scan to Pay, and Contactless SBI Credit Card options is permitting individuals to make secure and safe contactless funds with only a faucet of their card or cellphones.

Let’s have a look at these 3 contactless cost choices by SBI Card intimately:

Contactless Credit score Card

For funds as much as Rs. 5,000 clients can merely faucet their SBI Credit Card for a seamless transaction, with out the necessity of getting into their 4-digit PIN. There isn’t any have to swipe the cardboard or contact the contactless/NFC-enabled POS machine, if you end up utilizing Contactless SBI Credit Cards.

Nevertheless, any transaction above Rs. 5,000 requires the Cardholder to enter the cardboard PIN.

SBI Card Pay

With SBI Card Pay, you don’t even have to bodily carry your card anymore. Your android telephone is sufficient to do the job, for any transaction as much as Rs. 5,000. You may make quick and safe funds just by tapping your NFC-enabled android smartphone on an NFC-enabled POS machine, with out the necessity to enter a PIN.

Watch this video to know extra about SBI Card Pay:

Scan to Pay

100vw, 655px”><noscript><img data-attachment-id=) SBI Card Cellular App affords a QR-based handy and safe cost answer. To make a cost utilizing your cell phone, scan the QR code utilizing the Scan to Pay characteristic at any on-line / retail service provider that shows the Bharat QR emblem, authenticate with OTP and make the cost.

SBI Card Cellular App affords a QR-based handy and safe cost answer. To make a cost utilizing your cell phone, scan the QR code utilizing the Scan to Pay characteristic at any on-line / retail service provider that shows the Bharat QR emblem, authenticate with OTP and make the cost.