Products You May Like

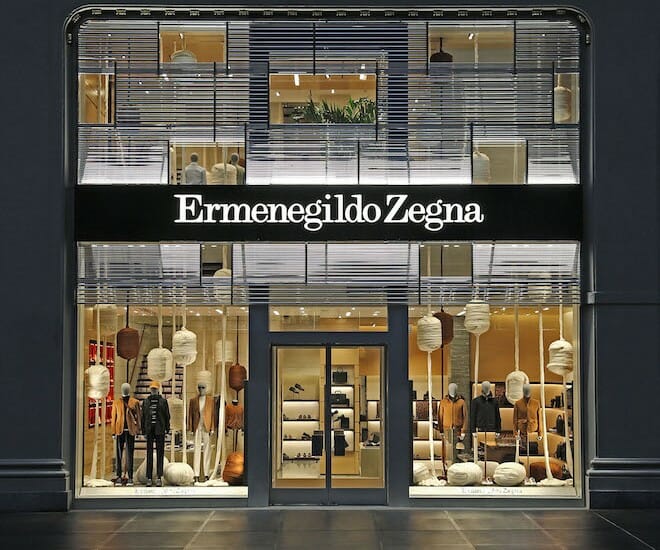

Credit score: Ermenegildo Zegna

Italian luxurious home Ermenegildo Zegna Group has agreed to go public by merging with Investindustrial Acquisition Corp. (IIAC), a US special-purpose acquisition firm. The deal values the world-renowned style home at US$3.2 billion.

Upon finalisation of the transaction — anticipated to occur within the fourth quarter of 2021 — the Zegna household will maintain onto the corporate’s management with a stake of roughly 62 per cent. IIAC can be supplied with an 11 per cent stake within the Italian model.

This can be a strategic shift for the 111-year-old family-run enterprise and follows a development of consolidation within the luxurious items market. In 2018, Michael Kors Holdings Ltd. acquired Versace for US$2.1 billion. Earlier this yr, LVMH Moët Hennessy Louis Vuitton SE bought Tiffany & Co. at US$15.8 billion. Not like these offers, nevertheless, Zegna’s transaction permits it to go public but retain a controlling stake.

Credit score: William Daniels

In a statement to FT, Gildo Zegna, the model’s 65-year-old CEO mentioned Zegna might have remained impartial for an additional 100 years, however felt the second was acceptable as “the world has modified lots and luxurious has grow to be very difficult”.

He added: “The chance got here and we took benefit. Scale is turning into necessary . . . with the best accomplice . . . we are able to do an excellent job in taking new alternatives if they arrive alongside.”

READ MORE: Moncler’s Acquisition Of Stone Island Is About “Fine-tuning Rather Than Change”

Zegna was based by Ermenegildo Zegna — Gildo’s grandfather — as a cloth maker in 1910. Since then it has grown into a worldwide main participant in luxurious menswear. It has hit quite a few milestones alongside the way in which, together with turning into the primary luxurious menswear model to open in China. Now, Higher China represents Zegna’s largest market.

In 2018, Zegna acquired the bulk stake in American luxurious style model Thom Browne. The transfer happened as Zegna sought to draw a brand new era of consumers. For the reason that acquisition, Thom Browne has doubled its revenues.

Attracting a youthful buyer base stays a key focus for the model.

Learn extra style information here.